Negative balances in your financial statements can signal errors or issues with your business performance. In some cases, a negative balance can be accurate, but it’s important to review further to be sure. Here are some things to watch out for in your Profit & Loss Statement and Balance Sheet.

Profit & Loss Statement

A negative revenue figure may mean that you had to credit a customer or customers for more than you sold in a given period.

Example: In January, you recorded $10,000 in revenue (this would show up as a positive figure, as it should). In February, you bill $4,000 in services to Client B. However, you also realize that you should only have billed $4,000 to Client A in January for the work that was completed. You would have to refund Client A $6,000 and would show a negative revenue of $2,000 in February.

Negative expense balances would indicate that you received a refund of some prior purchase, or you had an adjustment in your favor for some expense line item that you’ve been accruing each month.

Example: You expected a property tax bill of $24,000 for the year, so you’ve been accruing $2,000/month in expenses. When the bill comes at the end of the year, it is only $21,000. In December, you would have a negative expense amount for property taxes of $1,000 to true up the expense.

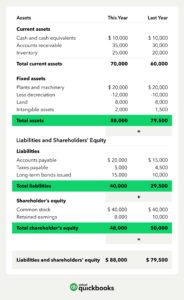

Balance Sheet

There are a few account balances that should always show as negative amounts, such as accumulated depreciation or distributions. This is because these accounts are showing reductions to the accounts they off-set.

Example: Fixed Assets purchases are reduced by Accumulated Depreciation, therefore it shows up on the Balance Sheet as a negative balance.

A negative balance in a liability account could mean that you were not appropriately recording the interest expense against the liability.

Example: As you make a payment on a loan, the principal portion of the payment gets recorded against the loan on your balance sheet, while the interest portion gets recorded as an expense to the P&L. A common mistake is that the whole payment gets recorded to the loan balance on the balance sheet and the interest expense never gets recorded to the P&L – this causes more payments to be recorded against the loan balance than the original amount of the loan, which pushes the balance negative.

A negative cash balance could mean that you’ve overdrawn your account or that you have some items to clean up in your register.

Example: If you had cut a check to a vendor, but they never cashed it, you may have re-issued a check. If you forgot to void the original check, then this check is going to show up twice, even though only one should actually clear the account. This could result in a negative balance on your balance sheet if the transaction is large enough (or there are many).

*** You should be reconciling your bank accounts monthly, reviewing for any unreconciled transactions!

By: Shauna Huntington