With FDIC limits still being a hot topic these days, we’ve seen lots of different tools being used for people and companies to diversify their cash and keep it safe. One tool to consider utilizing is a certificate of deposit (CD). There are several reasons to put your money in a CD:

1 – Safety and Security

CDs are considered low-risk investments because they are typically issued by banks and insured by the Federal Deposit Insurance Corporation (FDIC) in the United States. This means that even if the bank fails, the depositor’s funds (up to the FDIC insurance limit) are protected.

2 – Guaranteed Returns

CDs offer a fixed interest rate for a specified period of time, providing a predictable return on investment. This can be attractive for individuals who prioritize stability and want to know exactly how much interest they will earn.

3 – Preservation of Capital

By investing in a CD, individuals can preserve their principal amount (the initial deposit) while still earning interest. This can be particularly appealing for individuals who are risk-averse and want to protect their savings.

4 – Savings Goals

CDs can be a useful tool for individuals who have specific savings goals in mind and want to avoid the temptation of spending their money. By locking funds into a CD, individuals are less likely to access the money until the maturity date, helping them achieve their financial objectives.

5 – Diversification

CDs can be part of a diversified investment portfolio. By allocating a portion of their funds to CDs, investors can balance their risk exposure and potentially earn some interest while having other investments in higher-risk assets.

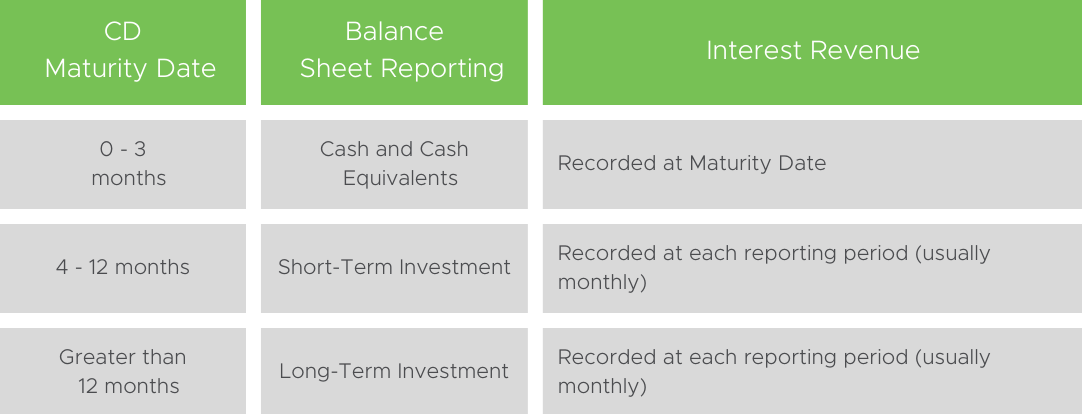

If you decide to invest your cash into a CD, you’ll need to make sure you understand how to account for the CD in your books. You should always check your CD terms as it could impact the way it’s presented in the financial statements. According to GAAP, a CD with a maturity date of 3 months (90 days) or less is considered a cash-equivalent. That means you record the CD under the cash section of your balance sheet at the value of cash put into the CD. At the maturity date, you’d record interest earned. If you’ve got a CD that matures in greater than 90 days, it’s considered a short-term investment. A CD maturity date of greater than 12 months is a long-term investment. For anything greater than 3 months, you’d record the interest income on a monthly basis, or whatever your reporting frequency is. The Interest Income would be in the Other Income section of your Income Statement.

A CD can be a great tool for diversifying your investments, while earning more than your standard checking or savings account!

Written by: Mandy Smith