Outsourcing accounting has become a more common practice in recent years. With companies looking for increased efficiency and a way to combat the talent shortage, outsourcing is becoming a part of the conversation. As companies consider whether outsourcing is right for them, there are various factors to consider.

Cost

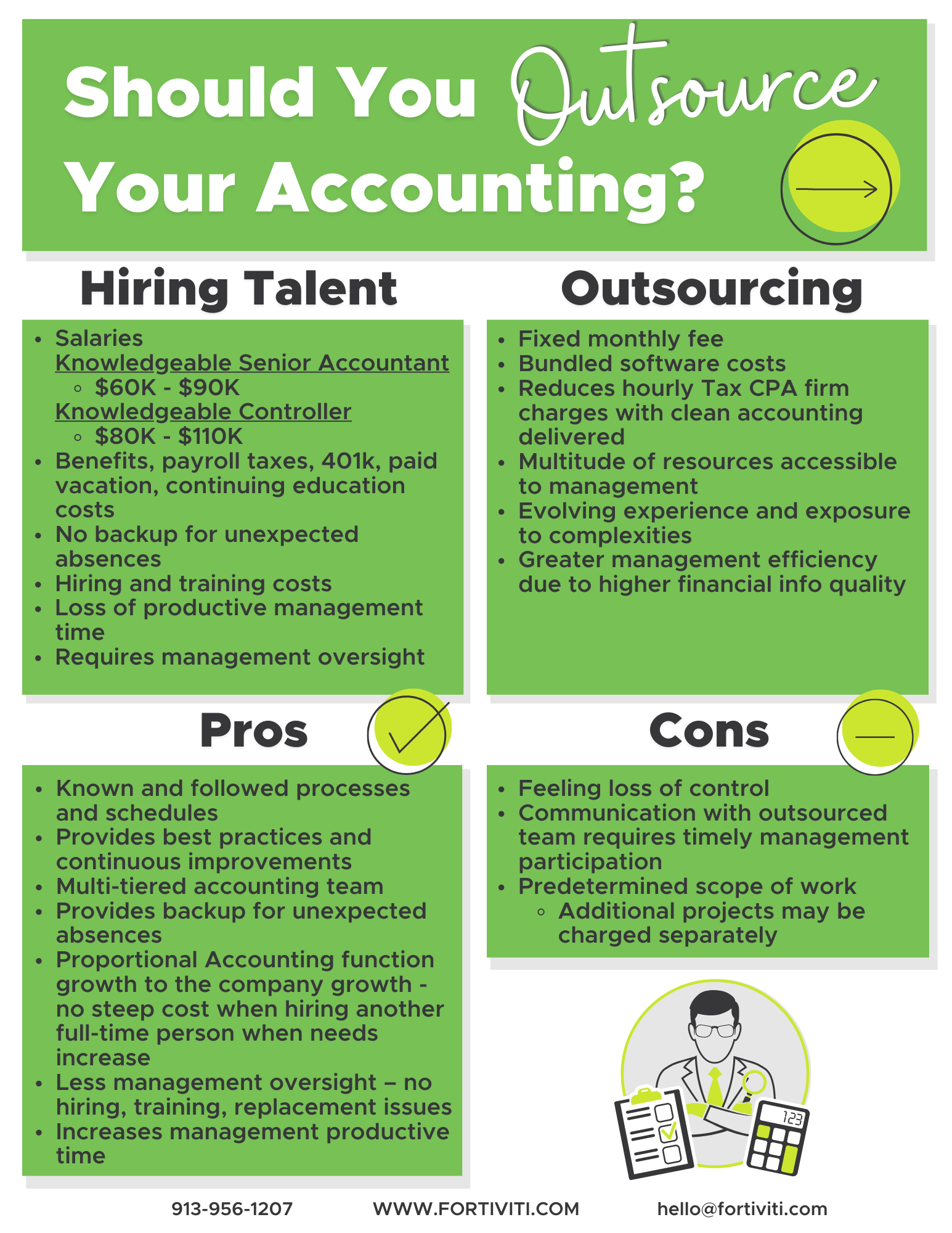

To hire decent talent, you pay for it. The current market for accounting professionals is anywhere from $67,000 – $130,000 annually. In addition to salary, the company must pay employee benefits, such as the employer portion of their health, dental, and vision insurance, employer payroll taxes, and unemployment insurance. If your company pays a 401k match and offers paid vacation time off, this adds an additional cost. As you consider the fully-burdened cost of an in-house hire, you need to add 20 – 25% of the employee’s salary.

benefits, such as the employer portion of their health, dental, and vision insurance, employer payroll taxes, and unemployment insurance. If your company pays a 401k match and offers paid vacation time off, this adds an additional cost. As you consider the fully-burdened cost of an in-house hire, you need to add 20 – 25% of the employee’s salary.

In addition to direct employee cost, you have the costs of equipment, software, training, and oversight. Make sure you build all costs into evaluating an in-house solution.

An outsourced solution may not always be less expensive than an in-house option. However, it may be very comparable when taking into consideration all costs associated with an in-house hire. For example, if you have a plan to hire an accountant at $75,000/year and an outsourced solution is going to cost you $6,000/month, you may think that the outsourced solution is not that much less expensive at $72,000 annually. However, when you do the math, you determine that it’s actually quite a bit cheaper.

| Salary | $75,000 |

| Employer Taxes | $6,500 |

| Benefits (health, dental, vision) | $5,000 |

| Retirement | $2,250 |

| Annual Software Costs (Accounting, Payroll, Office Suite, Adobe) | $6,000 |

| Computer and Office Equipment | $3,000 |

| Annual Training | $1,500 |

| Total Estimated Annual Cost of an In-House Hire at $75,000/year | $99,250 |

Scope

Another thing to consider as you are analyzing whether outsourcing will work for you is scope. As you customize an outsourcing relationship, you’ll develop a scope of work with your provider. Most providers will assist outside of that scope some, but there will come a point where a new discussion needs to be had to evaluate the work, the scope and the fees.

With an in-house solution, you have more flexibility. If you need to have your accountant answer the phones for a few weeks while your receptionist is out on leave, you can do that. You can have your accountant take on other smaller tasks when it doesn’t make sense to hire a full-time person to do, but that they have the capacity to handle.

This flexibility of having someone in-house can be both positive and negative. It’s nice, because you can utilize your staff for those things that are most important to you in the moment, without worrying about increasing your scope or cost. However, it can be a negative, because your accountant could be getting pulled into so many different directions that their most important task of keeping your finances in check gets put to the back burner.

Oversight

When it comes to your business finances, you want to ensure accuracy, compliance, and completeness. With an in-house solution, you want to make sure that you have the appropriate skills to either oversee the work yourself or the proper staffing levels to know that you’ve got someone overseeing the work being done by your accounting staff. Often, a business owner or leader in an organization doesn’t know what they should be looking for when it comes to their accounting and financials. If you choose to hire an in-house accountant, you may want to invest in an outsourced CFO or an annual financial statement audit, to help ensure that your accountant is doing things accurately and there isn’t anything untoward happening with your money.

With an outsourced solution (especially if you’re working with a team), you’re going to have your accountant that you work with, but they are going to have oversight and review being done of their work product. This helps to ensure that your financials are accurate and things are not being overlooked. In addition, an outsourcing solution will often have multiple different levels of staff, a technical team, and many team members providing the same services. This allows an outsourcing team to collaborate and ensure they are up to date on the latest trends, rules and regulations, systems and tools, and general accounting practices.

Redundancy/Hiring/Recruiting

One of the most painful experiences in any position in your business is turnover. In an accounting position, this can be extra critical, if you only have one accounting or finance person on your team. They may be the only one who knows how to get employees paid, process invoices, or pay your vendors. If that’s the case, business can literally stop if your accountant gives notice, has a medical or family emergency, or just doesn’t show up one day. If you are going to hire staff in-house to manage your accounting, payroll, and financial-related tasks, you should consider doing so when you have the ability to have at least two people on staff that can support each other and back each other up. If you only have one accounting team member, then you should ensure that you are well-versed in their job duties, systems, and processes. In addition, make sure you have access to all accounts and passwords so that you are not locked out in the event of an unexpected absence.

In addition to turnover affecting the work getting done, you then have the added task of sourcing, interviewing, hiring and training a replacement. This can take a significant amount of time away from handling sales, marketing, and delivering your product or service.

Outsourcing does not avoid the issue of turnover/transition altogether. However, it can be much less painful for you should you experience it. If you work with an outsourcing company that is process-driven and focuses on training, turnover shouldn’t have a significant negative impact. Another team member will simply step in, follow the company’s processes, and work with you to get up to speed as quickly as possible. Meanwhile, payroll gets processed, invoicing goes out, and money can keep coming in the door!

Processes

Developing processes in your accounting and finance function is critical to getting your business ready for scale. Often, when hiring someone in an accounting role within the business, someone who will be good at the accounting work, won’t necessarily be the best person to develop and implement processes. This is often a unique skillset. If you hire an in-house team member to manage your accounting, you may want to consider consulting with an operational efficiency expert or process documenter to get your processes implemented for long-term continuity and efficiency.

With an outsourced accounting solution, there are typically team members in place that focus solely on the documentation of processes. An outsourcing company will also already have standard processes that they follow that can be adapted to fit your business. Streamlined, standardized processes can be one benefit of outsourcing. However, you may also need to be flexible with how your business operates, frequency of tasks, delivery models, etc.

Evaluate your Options

As you evaluate your business and its accounting needs, consider your options. Outsourcing can be a great solution to consider for your business if you are too small to want to hire in-house, you don’t want to manage a team of accountants in-house, or you just aren’t sure where to start. However, make sure that you consider the limitations to outsourcing and your ability to work within the parameters of an outsourced solution. You’ll want to be sure that you make a decision that is going to work best for your business.

If you feel outsourcing is right for your company and Fortiviti could be a good fit for you, read our blog on Frequently Asked Questions about Working with Fortiviti!

Written by: Mandy Smith