Tax Law

Employing your Children in Your Business

As a business owner, you are constantly looking for potential tax breaks or options for shifting income. If you have children, one option to consider is putting your kids on...

Beware of Third Parties Selling You The Employee Retention Tax Credit

What is ERC? The Employee Retention Credit (ERC) has been a hot topic since 2020, when the Coronavirus pandemic changed the world. The credit was implemented to aid companies in...

Paying Your Taxes

Be Prepared Your business is profitable! Congratulations! You owe taxes! Contrary to popular belief, owing taxes is not a bad thing. It means your business made money. Yes, it’s great...

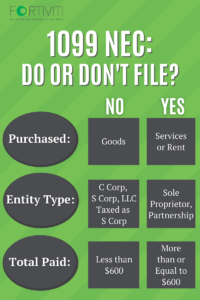

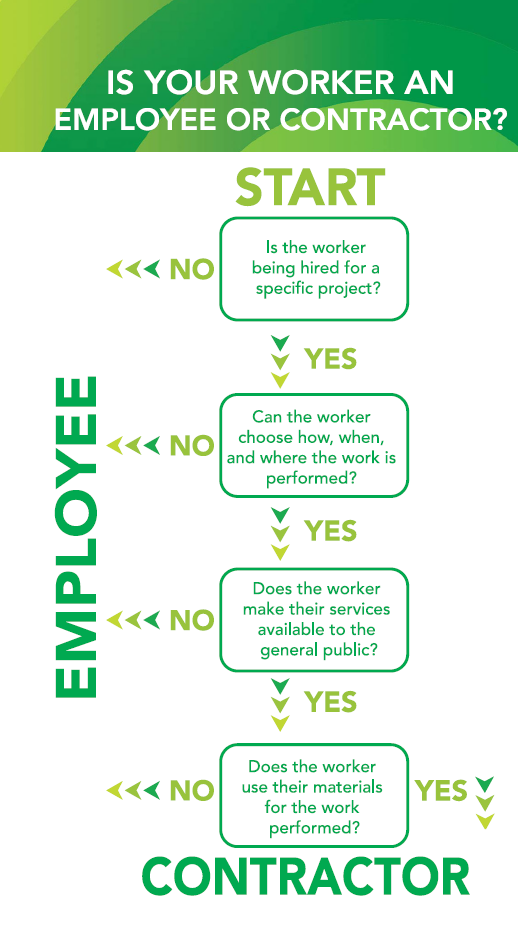

1099-NEC: To File Or Not To File?

It’s a magical time of year, to start fresh and set new goals for you and your company! After you’ve looked ahead at the year to come and all the...

Why Keep Receipts?

In business, it is important to have good records. However, in the day-to-day dealings of running a business, some smaller things, like receipts for expenses, seem to move to the...

NEW Tax Estimation Calculator

Did you get the refund you were expecting last year? The IRS has always had an estimated tax calculator for tax payers to use in order to estimate their taxes...

Changing Your Business Name – What You Need to Know

Congrats on your business name change! You’ve put in hours of brainstorming, writing, re-writing, and crafting to come up with your new name and brand. But now that you have...

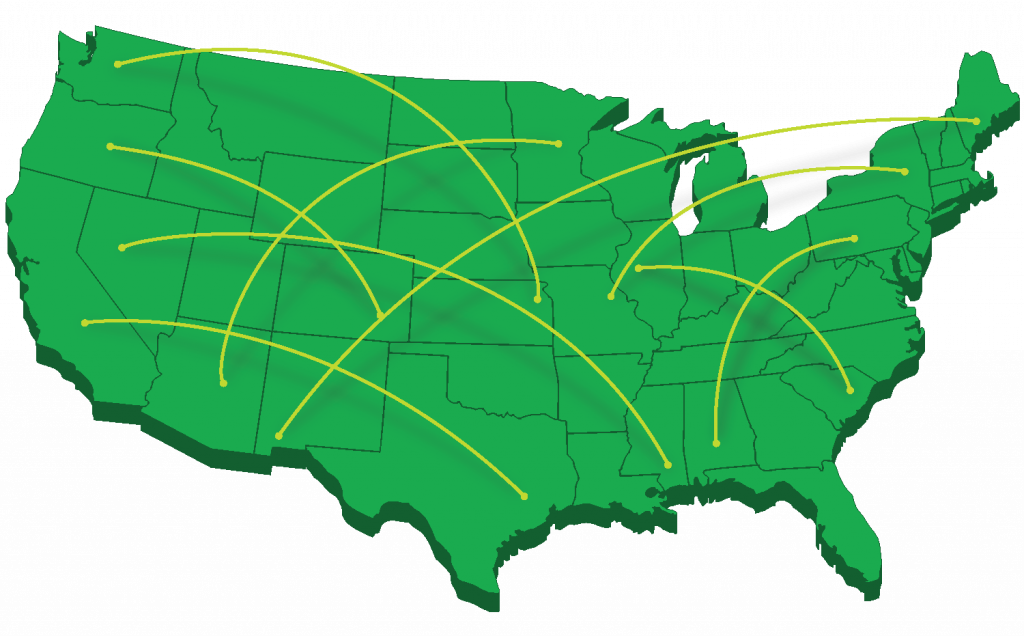

Crossing State Lines – Employment Considerations

Crossing state lines can grow your business. However, as an employer, it also means you must be aware of the different laws related to employment and business in each state....

Personal Use of Company Vehicles

If your employees are driving a company-owned vehicle, it is important that they keep detailed records of the miles driven for business and those driven for personal use. The breakdown...