Tax Law

Personal Use of Company Vehicles

If your employees are driving a company-owned vehicle, it is important that they keep detailed records of the miles driven for business and those driven for personal use. The breakdown...

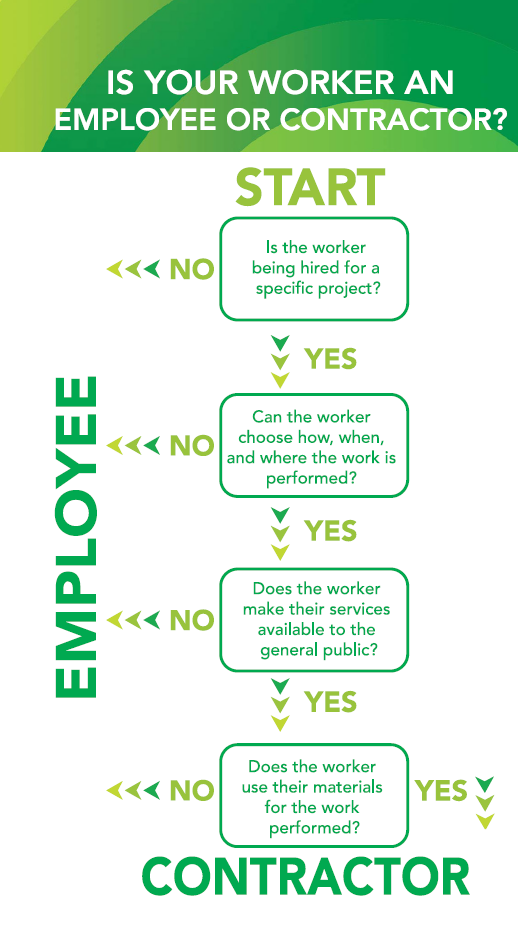

Employee vs. Contractor:Control and Relationship

Sometimes in small business, the idea of paying those who work for you as contractors sounds ideal. But, how does a business owner know to correctly classify a worker as...

1099s: Tips & Tricks

1099s are due January 31st - have yours been sent? If you have, have you sent them to all vendors and service providers who need one? You might think that...

New Mileage Rate for 2019!

It's a new year and the IRS has once again updated the mileage rate for 2019. Beginning January 1, 2019, the standard mileage rate increased from 54.5 cents in 2018...

Sales Tax Changes are Imminent for Online Retailers

Online Sellers might have to start collecting sales tax regardless of nexus. On June 21, 2018 the Supreme Court case South Dakota v. Wayfair, Inc. ruled that states have the...

- « Previous

- 1

- 2