financing

Beware of Third Parties Selling You The Employee Retention Tax Credit

What is ERC? The Employee Retention Credit (ERC) has been a hot topic since 2020, when the Coronavirus pandemic changed the world. The credit was implemented to aid companies in...

Reviewing your Financials: Top Five Things to Look For

If you’re getting regular monthly financial statements in your business, you’re already ahead of many business owners. But financial reports are only as good as the time you put in...

Outsourcing Your Accounting: How to Make it Work

Outsourcing is becoming a more common practice in business. Whether it’s marketing, accounting, sales, or even operations, outsourcing has become easier than ever. But, outsourcing only works if you do....

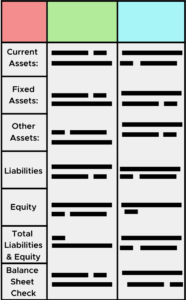

Your Balance Sheet: Why It’s Important

A balance sheet is one of the least reviewed financial statements in a small business. Yet, it shouldn’t be. Your balance sheet is important for a number of reasons: ...

What You Need to Know About Debt-to-Equity Ratio

If you’ve ever looked at obtaining financing for your business, you’ve likely heard of the debt-to-equity ratio. But, what is it? And, what does it mean to lenders? Here's what...

3 Methods for Evaluating Your Business to Determine its Value

What is Your Business Worth? If you’re a business owner, chances are you’ve had this question before: What is your business worth? After all, the end game for many entrepreneurs...

Accounts Receivable Financing: What You Need to Know

For many small business owners, selling accounts receivable may be one of the only methods to financing. The qualification criteria is much less stringent than traditional bank financing and factoring...

How to Use a Credit Card to Finance Your Business

Securing financing for a new enterprise can be a challenge. While there are many options for financing available - bank loans, investors, vendor credit - most are hard to...

- « Previous

- 1

- 2