taxes

4 Tips to Accurate and Timely Payroll Processing

Ensuring your payroll is processed accurately and on time is essential for maintaining employee satisfaction and organizational stability. Late or inaccurate payroll can lead to tax penalties, employee concerns, and...

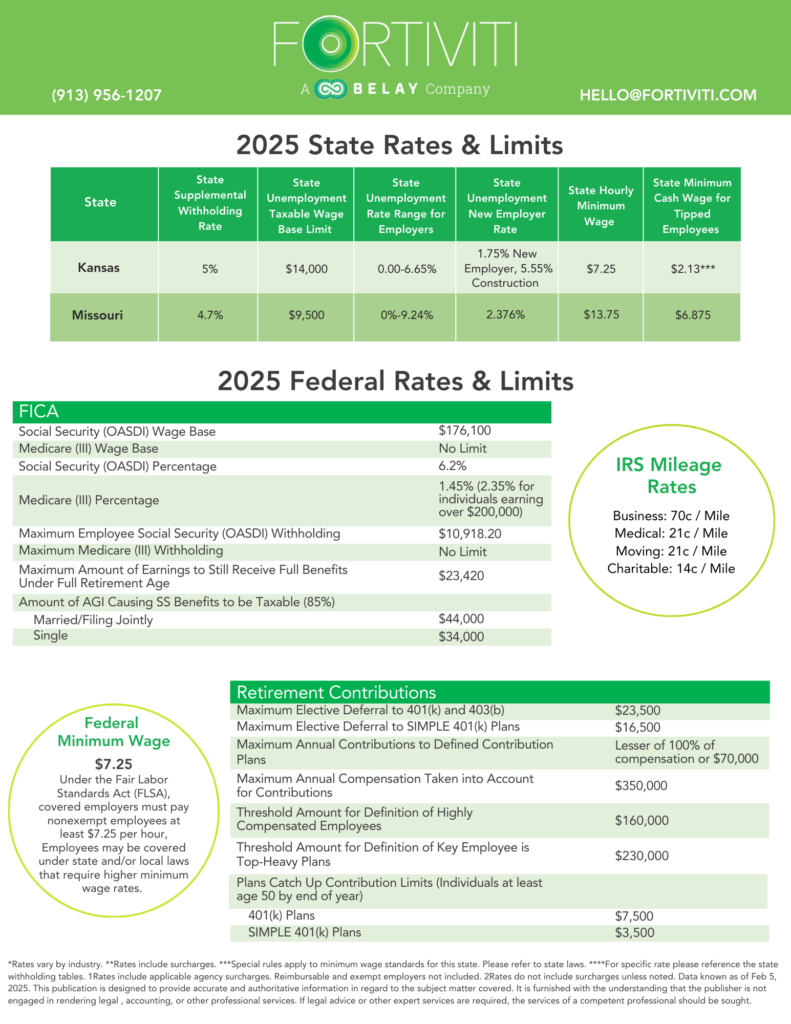

2025 Tax Deadlines and Breaks: What Every Small Business Needs to Know

Now that most individuals and companies have closed out their 2024 books, it's time to focus on the 2025 tax year that we are currently in. We often push one...

Frequently Asked Questions about Working with Fortiviti

June 2023 Fortiviti is a unique outsourced accounting solution, so naturally, we get a lot of questions on how we operate! Here are some of the top questions we get...

Paying Your Taxes

Be Prepared Your business is profitable! Congratulations! You owe taxes! Contrary to popular belief, owing taxes is not a bad thing. It means your business made money. Yes, it’s great...

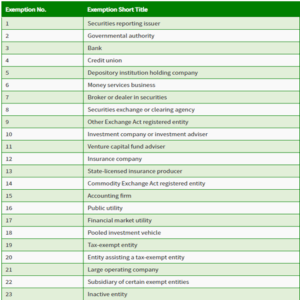

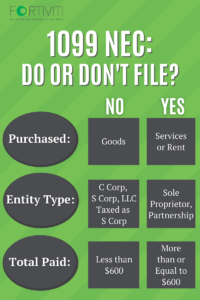

1099-NEC: To File Or Not To File?

It’s a magical time of year, to start fresh and set new goals for you and your company! After you’ve looked ahead at the year to come and all the...

Families First Coronavirus Response Act

On March 18th, 2020, Congress signed the Families First Coronavirus Relief Act into law to provide additional benefits to those impacted by COVID-19, giving employees paid leave, who may not...

NEW Tax Estimation Calculator

Did you get the refund you were expecting last year? The IRS has always had an estimated tax calculator for tax payers to use in order to estimate their taxes...

Selecting the Best CPA for your Business

Business owners are pulled in multiple directions every day. Therefore, it is important to invest the time and energy into finding the right advisors to help you on your journey. ...